Like all states in the US, Delaware also demands having а corresponding certificate for a list of occupations and practices. Finally, once you’ve been accepted for licensure, you may now freely practice as a claims adjuster in the state of Delaware. Finally, once you’ve submitted your application the license application will be reviewed by the state board and depending on the results your certification for licensure will arrive in 2-4 weeks. Next, you must submit your fingerprints and background check along with an application for licensure, the fee for an online application is $100. You may receive your passing test results a week after the exam, and once you’ve received your passing score you’re now allowed to apply for a Delaware license.

The next step is to take the Delaware adjuster state exam and the required fee for the exam is around $60. Before applying for licensure in the state of Delaware, it is a requirement that you complete your pre-licensing courses from a state-accredited program. Next, you must choose what type of adjuster you would like to become, a staff adjuster, independent adjuster, or a public adjuster. In order to become a claims adjuster in the state of Delaware you must first obtain a high school diploma or GED. Finally you may freely practice as a licensed CPA in the state of Delaware, and must complete the required continuing education which are 80 hours of required coursework over a 2-year period. Once you’ve submitted your application you will await for approval of licensure from the state department. To apply for a CPA license you must fill out the required state application, and submit your information such as, certifications, required hours of coursework, and your required experience which you’ve completed. After finishing the required experience and passing the Uniform CPA exam, you’re now eligible to apply for licensure.

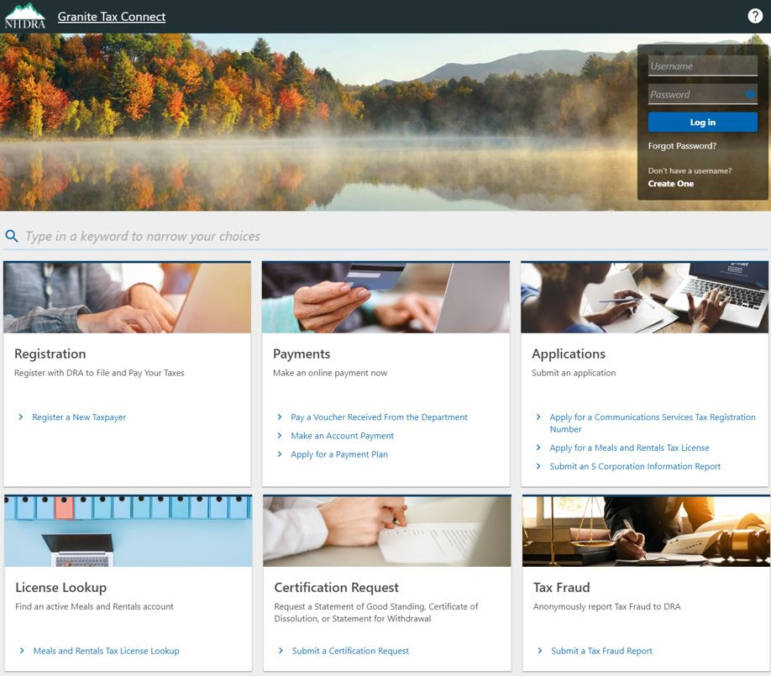

NH BUSINESS LICENSE LOOKUP PROFESSIONAL

Once you’ve gained the technical experience to gain a professional license, you must apply for your Delaware license. The next step is to complete one year of accounting experience which must be gained in public practice. After you’ve passed the state exam you’ll receive a CPA certificate via mail, and must complete the Professional Ethics: The (AICPA) American Institute of Certified Public Accountants Comprehensive Course. Once you’ve studied for and passed the state licensing exam, you’ll now need to gain the required amount of experience in order to apply for state board licensure. The next step would be to apply for the Uniform CPA exam, you’d apply through the National Association of State Boards of Accountancy’s (NASBA). During your pre-licensing courses you must complete 120 semester hours of college education and 24 semester hours of accounting courses. The first step in obtaining your Delaware CPA license is to graduate from a state-accredited college with a bachelor’s degree or higher.

NH BUSINESS LICENSE LOOKUP HOW TO

If you’re having trouble figuring out your career path or how to progress through your career path, this list will give you assurance. The following is a list of compiled major licenses which Delaware has to offer. From A-Z we have narrowed down the major licenses the state of Delaware has, you can expand your field from an adjuster license all the way to becoming a plumber. There are surmountable amounts of jobs and opportunities to choose from in Delaware, here we have arranged a list of major licenses Delaware has to offer.

0 kommentar(er)

0 kommentar(er)